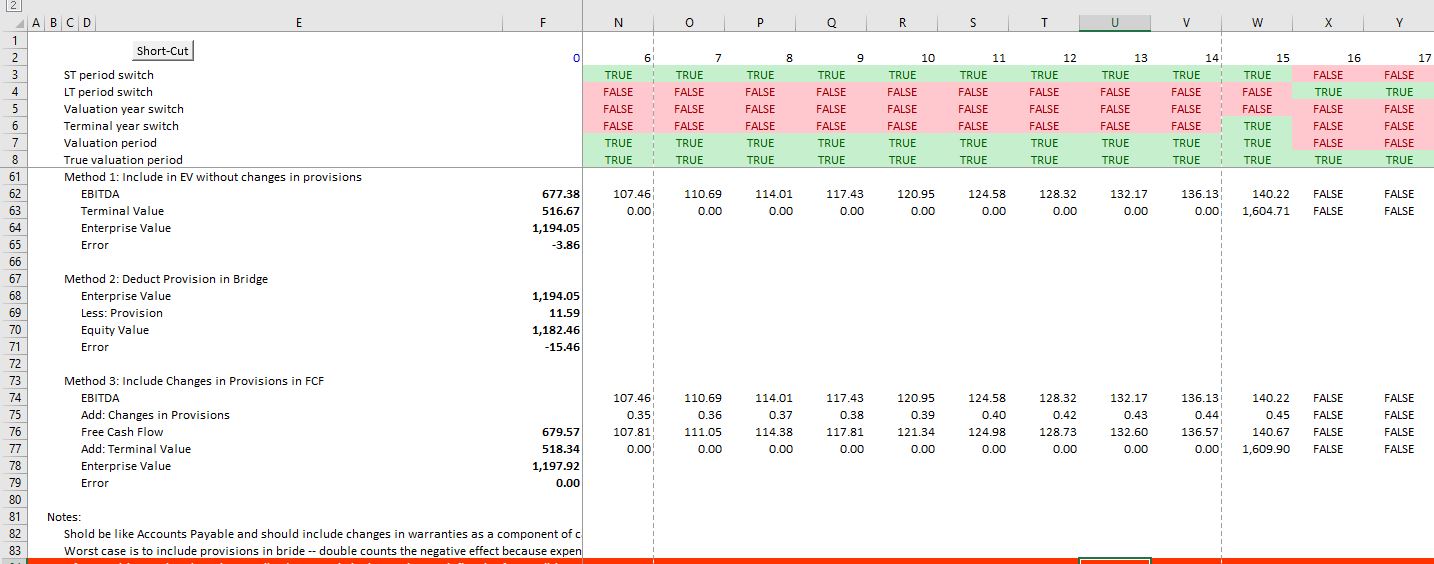

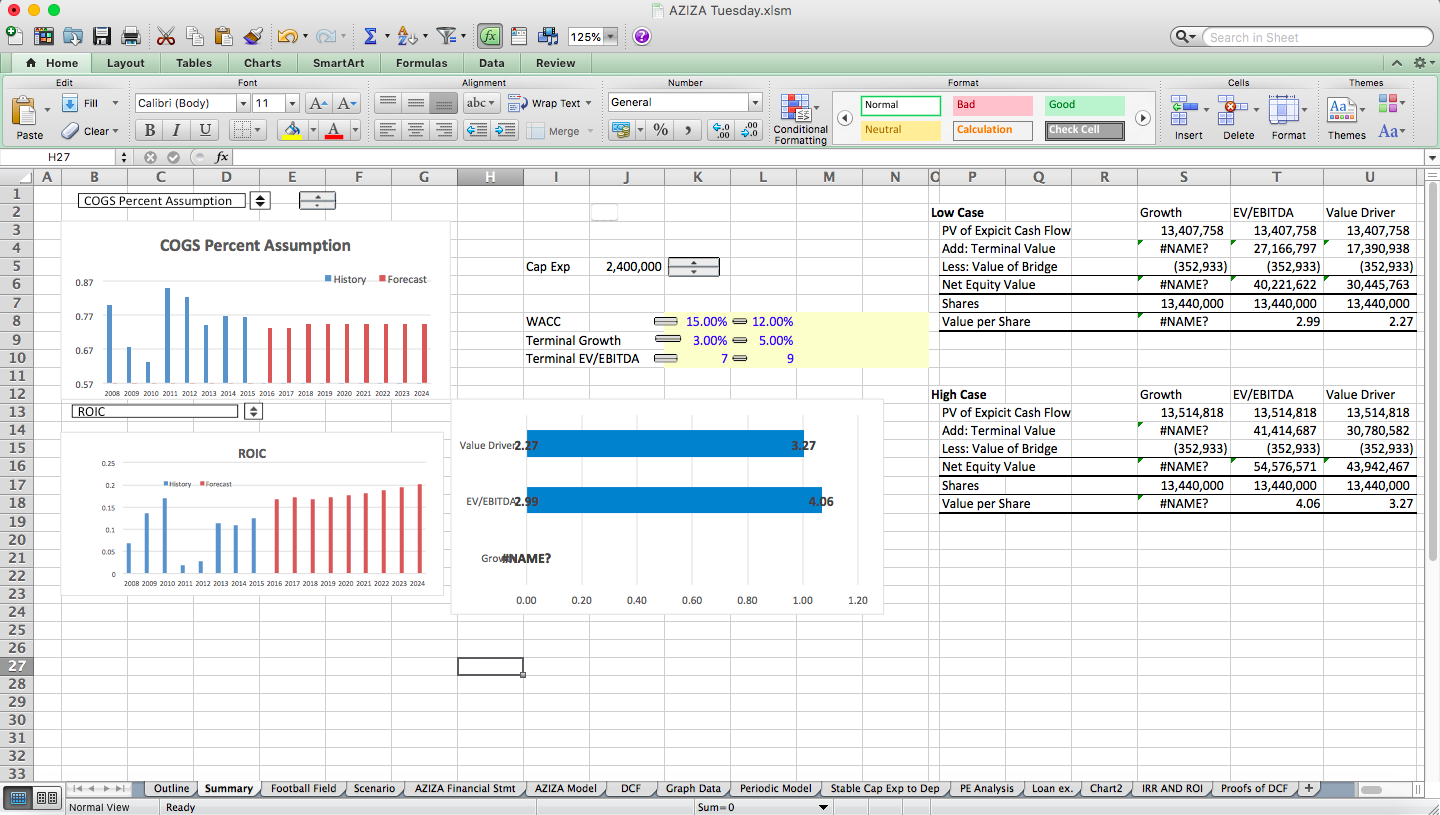

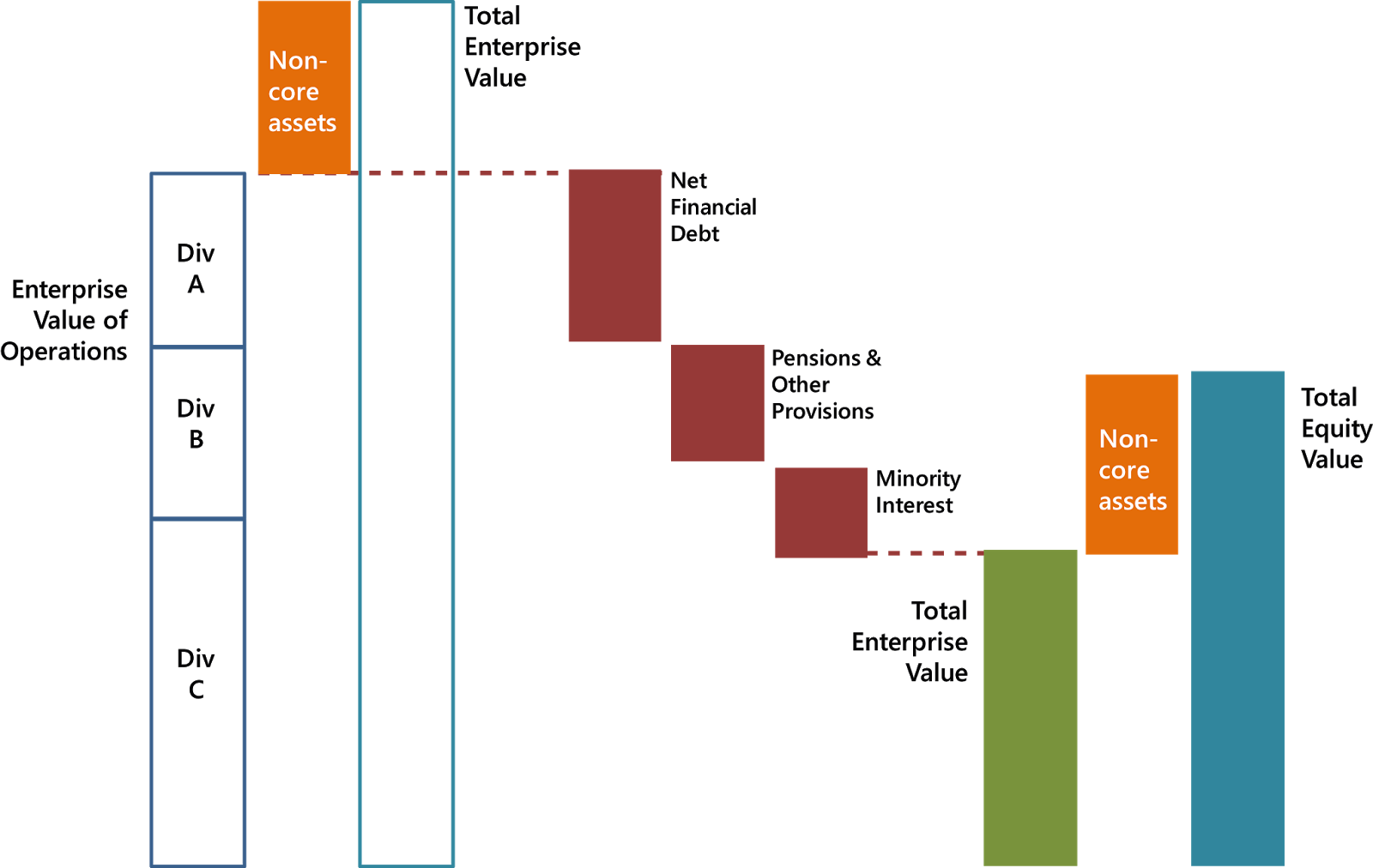

EV to Equity Bridge -Detailed Enterprise value JVs and associates + Financial investments + Debt equivalents NCI Preferred shares Common equity and options = Cash and equivalents + Non-core assets + Debt _ _ _ _ Title: EV to Equity Bridge - Detailed Author: alan brooke Created Date:. This video shows you how you can get from the value of operating assets to equity value in a generalized scenario, when there are other non-operating assets.

Bridge from Enterprise Value to Equity Value Edward Bodmer Project and Corporate Finance

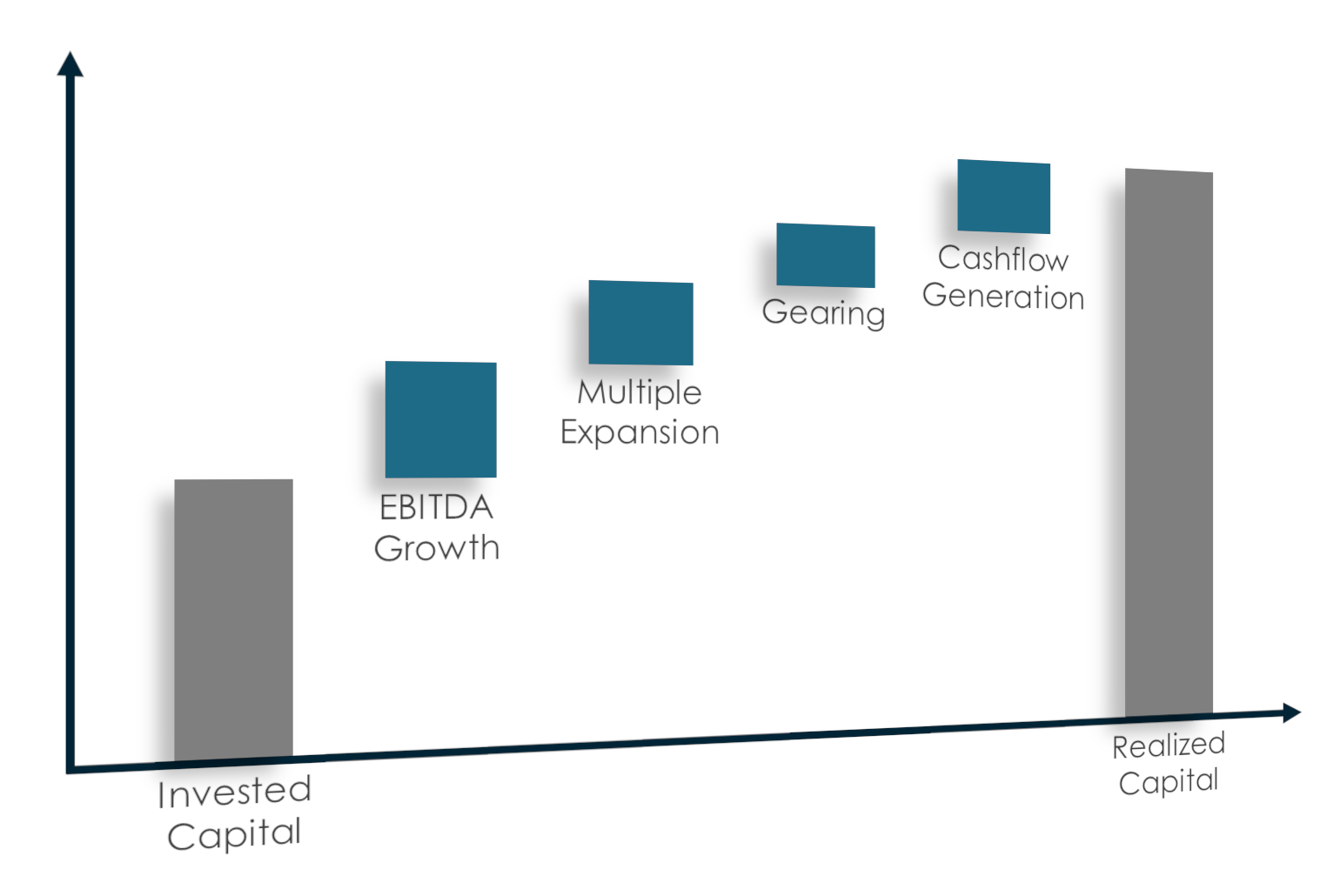

Value Creation in Private Equity

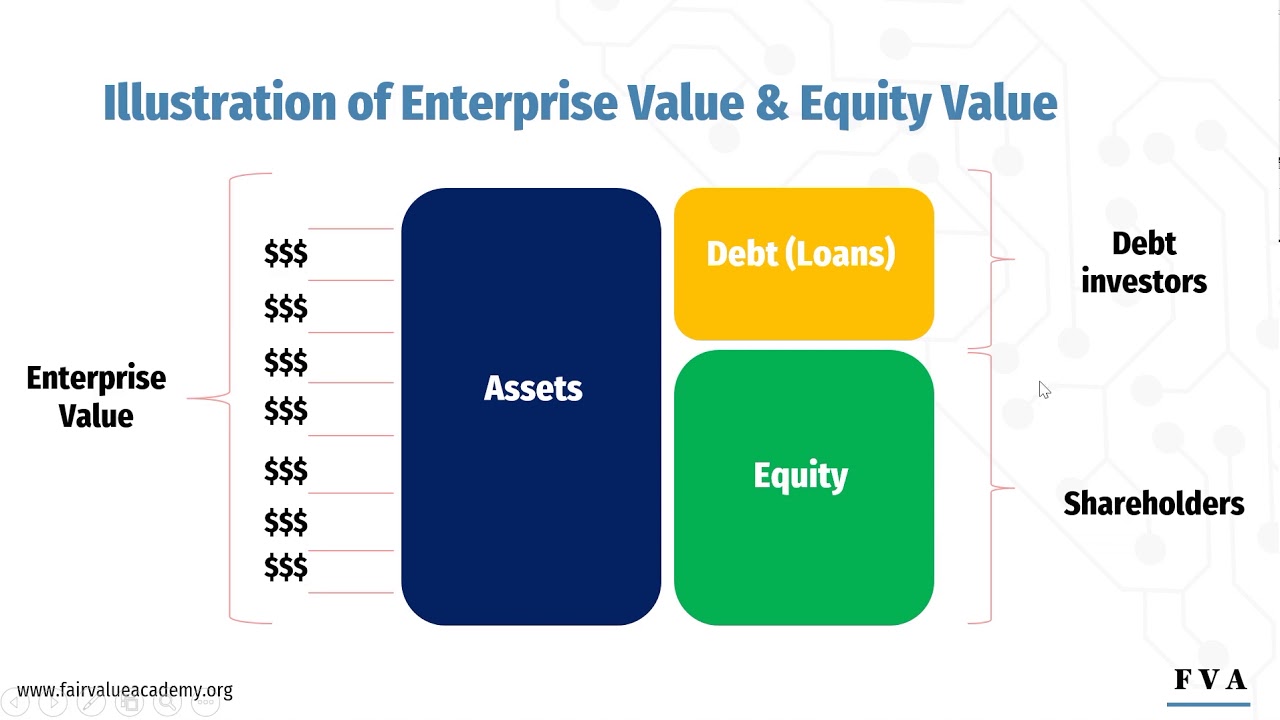

2 Enterprise Value vs. Equity Value YouTube

Equity and Enterprise Value Bridge Financial Edge

How To Calculate Enterprise Value For Private Company Haiper

What is Enterprise Value? Formula + Calculator

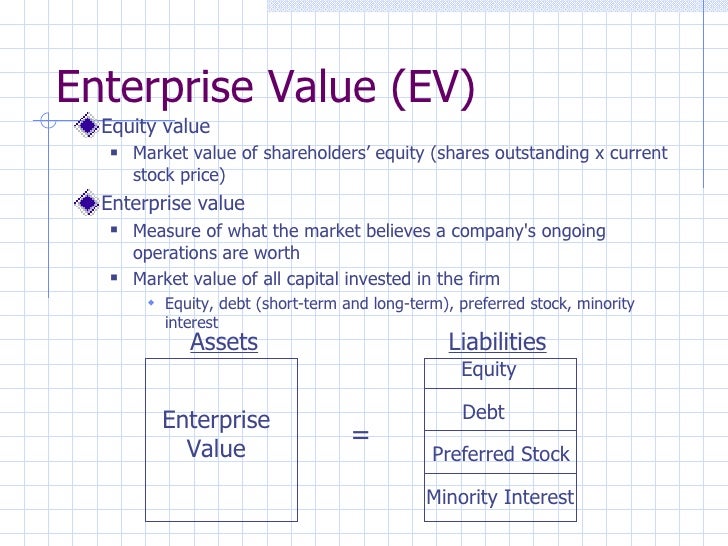

Enterprise Value vs Equity Value Complete Guide and Examples

Bridge from Enterprise Value to Equity Value Excel Model Eloquens

Enterprise Value vs Equity Value Price Bailey EUVietnam Business Network (EVBN)

Enterprise Value vs Equity Value Eqvista

:max_bytes(150000):strip_icc()/Enterprisevalue-f187d033e3284b8397489a4b7825848b.jpg)

Enterprise Value (EV) Formula and What It Means

What is Enterprise Value? Formula + Calculator

Bridge from Enterprise Value to Equity Value Excel Model Eloquens

The Bridge Between Enterprise Value and Equity Value YouTube

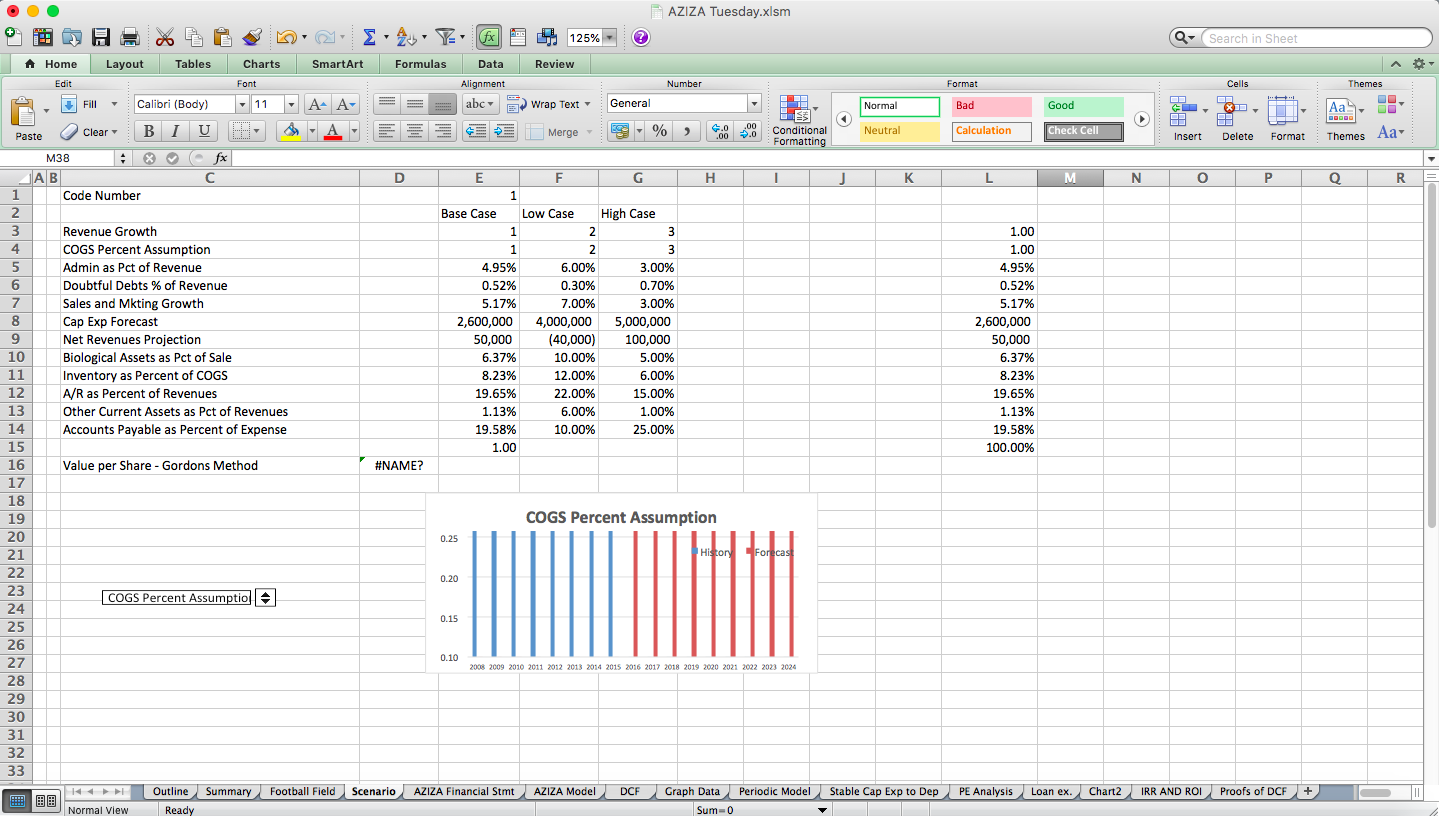

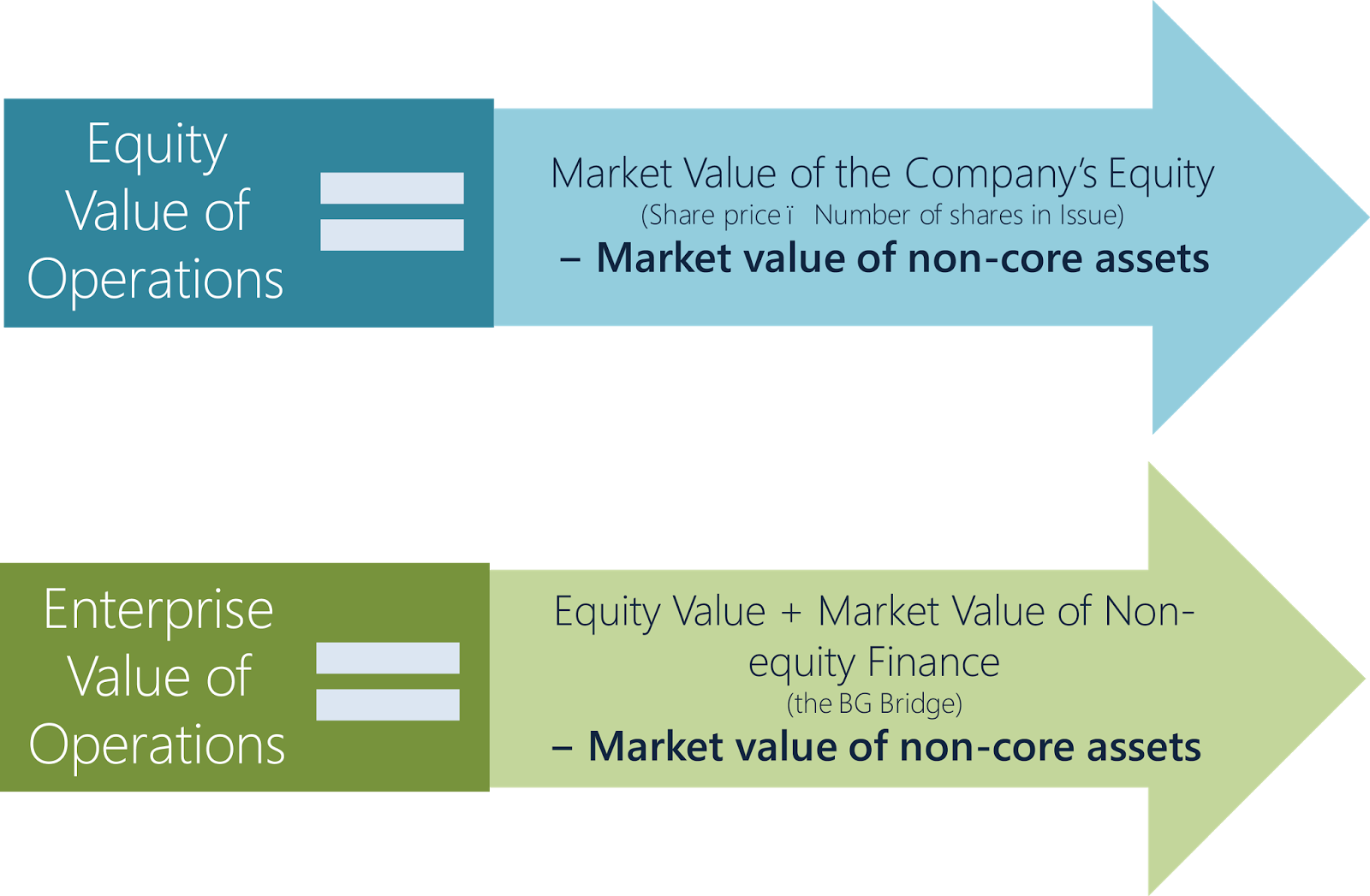

Experts in Financial Training Capital Analysis or Valuation?

Enterprise Value vs. Equity Value Everything You Need to Know

Experts in Financial Training October 2014

Why Your Valuation Bridge Matters to LPs eVestment

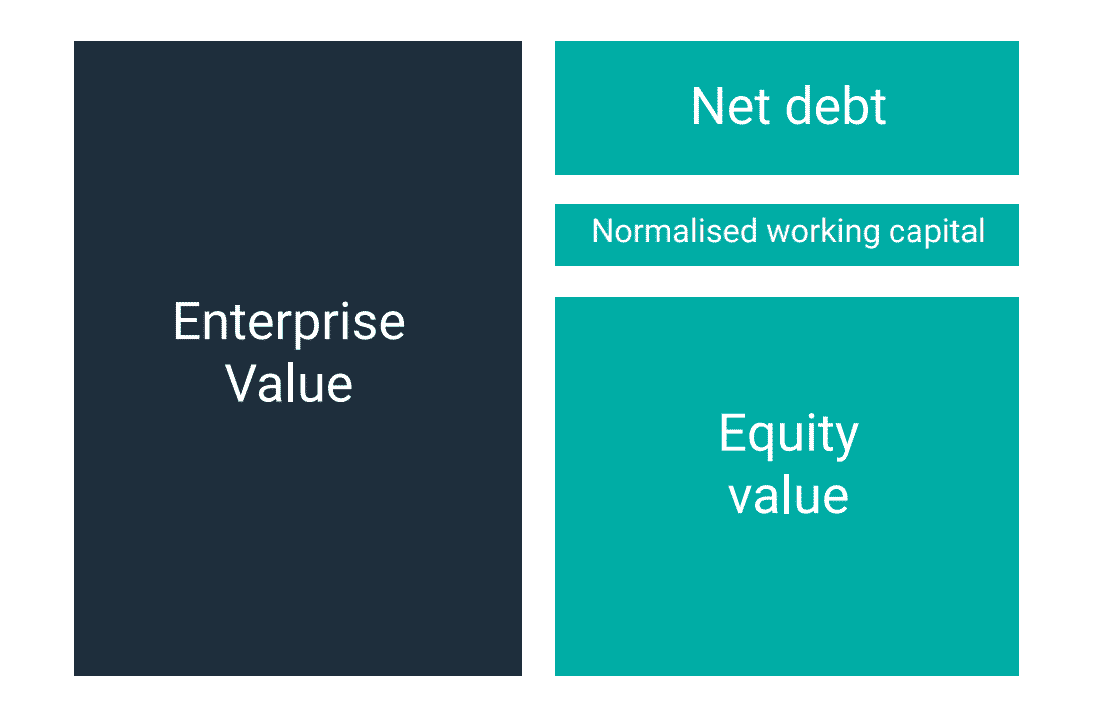

Equity Value to Enterprise Value Bridge Formula + Calculator

Enterprise Value (EV) YouTube

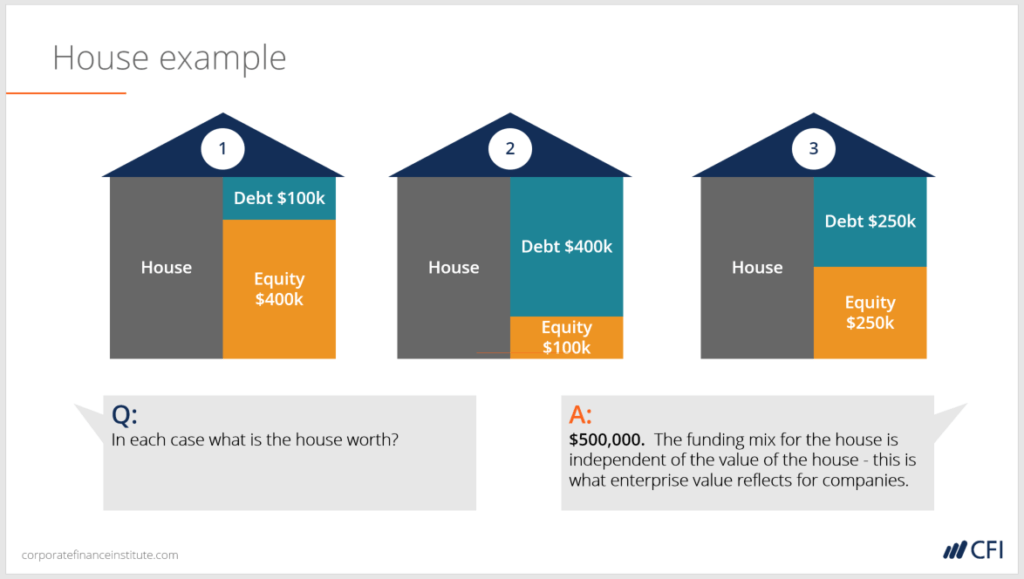

Enterprise Value is often termed as the takeover price because, in the event of a takeover, EV is the effective selling price of the company. The formula for Enterprise Value is as follows: Enterprise Value = Market value of common stock + Market value of preferred equity + Market value of debt + Minority interest - Cash.. The value of the property plus the house is the enterprise value. The value after deducting your mortgage is the equity value. Imagine the following example: Value of house (building): $500,000. Value of property (land): $1,000,000. Box of cash in the basement: $50,000. Mortgage: $750,000.