by the value of the car you choose to package. A novated lease is tax effective because in most cases your income tax savings will be greater than the FBT payable on your car. If your taxable salary is less than $180,000 per annum, nlc will structure your salary package using a combination of pre and post-tax deductions. The post-tax deductions.. Simon enters into a novated lease with his employer and a finance company that entitles him to use a plug-in hybrid electric vehicle. The lease begins on 1 April 2024 and is for 3 years, to 31 March 2027. There is an option to extend the lease for a further 2 years from 1 April 2027.

Novated Leasing Smartleasing

The 7 Pros and Cons of a Novated Lease Is It Worth It?

Novated Lease

Novated Leases how they work explained Fleet Auto News

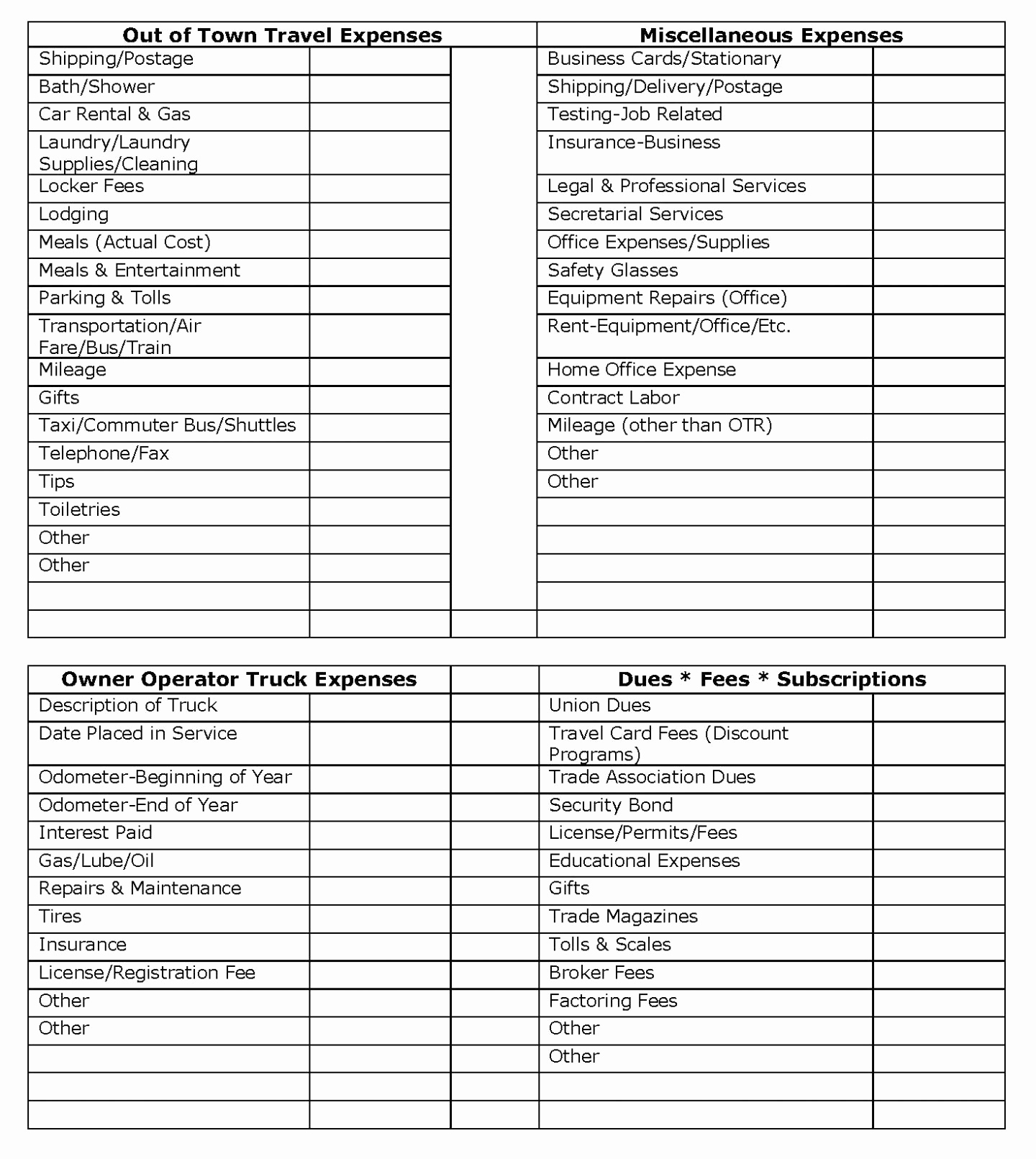

Novated Lease Calculator Excel Spreadsheet —

Novated Lease Calculator Excel Spreadsheet —

What is a novated lease and how does it work? Here's everything you need to know Flare HR

Novated Lease Calculator All Explained (2022 Update) Novate It

Novated Lease basics The eco car LCT threshold explained in full — Auto Expert by John Cadogan

Novated lease guide Toyota Fleet Management

Are novated lease worth it in 2023?

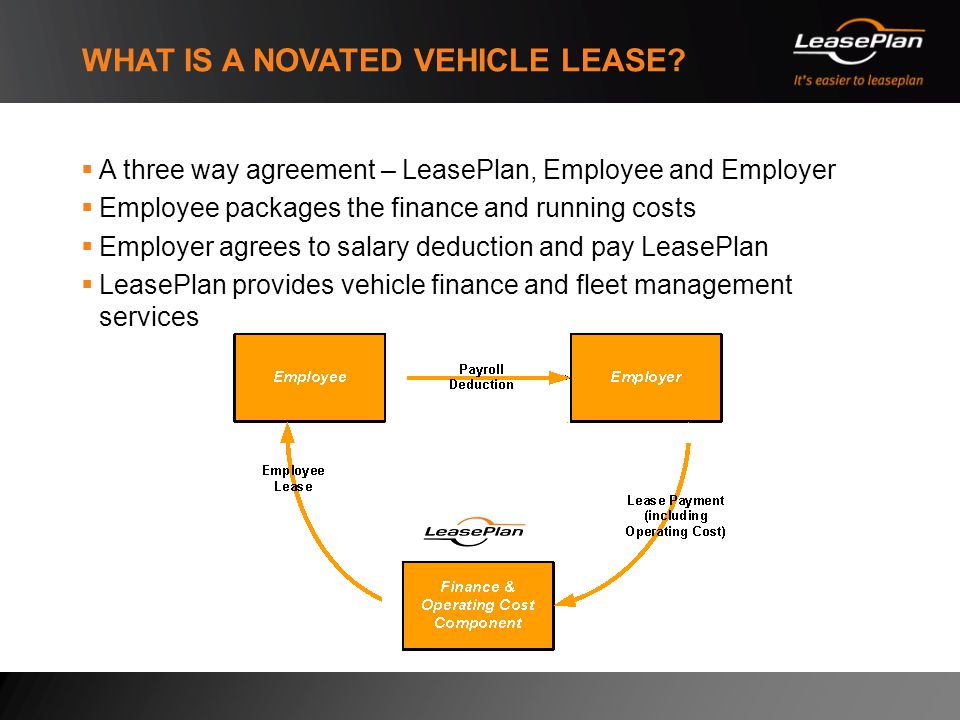

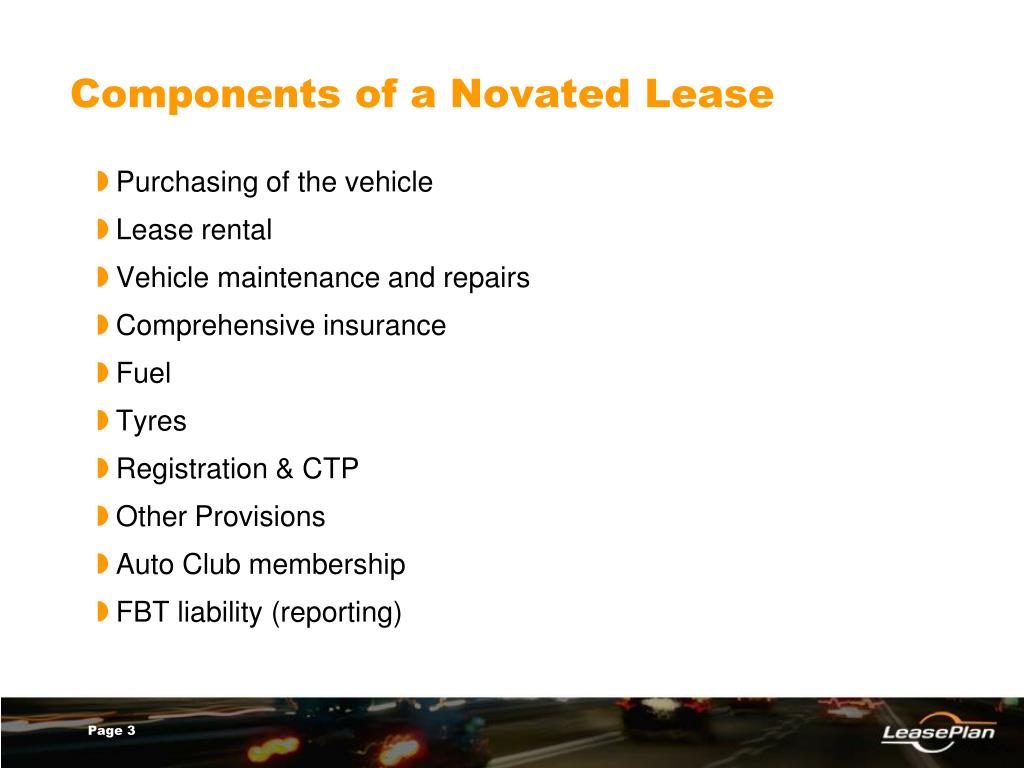

LEASEPLAN NOVATED LEASES. AGENDA What is a novated lease Why Novate? Why Novate with LeasePlan

Novated Lease Infographic

Novated Lease Calculator Spreadsheet for Example Of Novated Lease Calculator Spreadsheetlease

What are the benefits of a novated lease?

PPT LeasePlan Novated Leasing Presented by Peter Boutros & Trevor Warner PowerPoint

EMPLOYEE NOVATED LEASING SalaryMasters

Fillable Online NOVATED LEASE QUOTE REQUEST FORM Fax Email Print pdfFiller

Novated leasing TreadX

What is a Novated Lease? How do they work? We explain.

As 2021 calendar year hits the half way mark, the ATO is continuing with its playbook of targeting individual taxpayers. This time, it is targeting taxpayers that have entered into novated leases to obtain vehicles. Data will be obtained from various novated lease companies for the 2018-19 to 2022-23 financial years to ensure that individuals are not overclaiming deductions. Employers will.. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. If you can answer Yes to any of the following questions, your vehicle is considered by state law to have a business use and does not qualify for personal property tax relief. Is more than 50% of the vehicle's annual mileage used as a business.